Our Maw Your Realtor Diaries

Wiki Article

How Maw Your Realtor can Save You Time, Stress, and Money.

Table of Contents6 Easy Facts About Maw Your Realtor ExplainedMaw Your Realtor for BeginnersOur Maw Your Realtor IdeasExamine This Report about Maw Your RealtorThe Definitive Guide to Maw Your RealtorThe Single Strategy To Use For Maw Your Realtor

You may additionally have a hard time to find adequate occupants to fill up that workplace building or retail facility you acquired. This is when you purchase a house for a reduced cost, restore it swiftly and after that sell it for a rapid revenue.You're not interested in monthly leas when turning a house. Rather, you require to purchase a house for the cheapest possible cost if you desire to make a good revenue when offering.

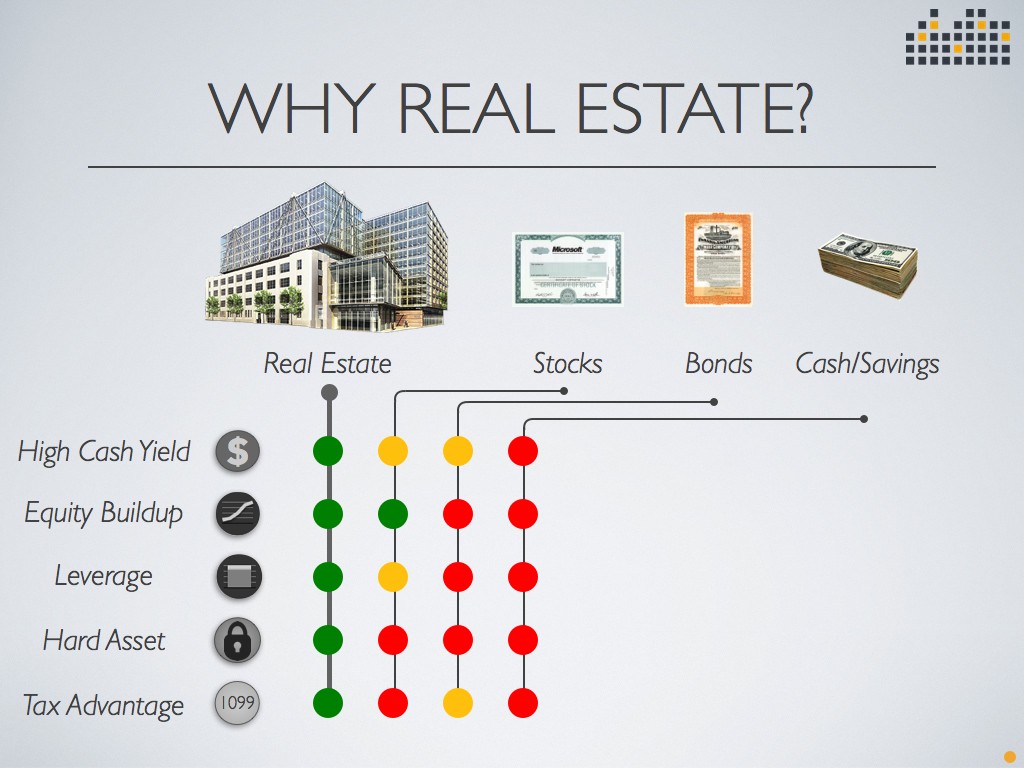

Diversifying your financial investment profile is important. If you place all your eggs in one basket, you could suffer an overall loss in the blink of an eye. Yet when you spend some funds in the stock exchange, various other funds in bonds or ETFs, and some in property, you boost your chances of higher revenues as well as less losses.

The Only Guide for Maw Your Realtor

Neither is accurate, as well as to reassure you, below are 8 fantastic reasons realty is an excellent financial investment. The Leading Reasons Property Is a Great Financial investment If you're thinking of investing in realty, you will start one of the most effective financial investment journeys of your lifetime.There aren't also lots of other financial investments that enable you to invest in properties worth much even more than you need to spend. If you have $10,000 to spend in the stock market, you can usually get just $10,000 worth of supply. The exemption is if you spend for margin (obtain), but you should be a recognized investor with a high total assets to make that occur.

For instance, let's claim you found a residence for $100,000; if you take down $10,000, opportunities are you could locate a funding to finance the remainder as long as you have excellent debt and steady income. Keeping that, it means you spend simply 10% of the asset's value and possess it.

The Best Guide To Maw Your Realtor

Unlike stocks or bonds, you can require the property to appreciate. It seems odd, however it's possible. First, know that realty values naturally. Typically, property values 3% 5% a year without you doing anything other than maintaining the home. You can raise the price of gratitude by making remodellings or repairs.

The Basic Principles Of Maw Your Realtor

When you buy supplies or bonds, you can just write off any type of funding losses if you market the property for less than you paid for it. If you purchase and hold property, you can gain monthly cash flow renting it out, and this boosts the earnings from owning real estate because you aren't relying only on the recognition yet the month-to-month rental income. maw your realtor.Roofstock Marketplace is an excellent resource. They not only listing offered investment homes for sale, however a number of them have occupants with leases in area currently. When you get the home, you quickly end up being a property owner. Roofstock likewise provides a lot of due persistance, researching you, so all you have to do is buy the residential property you believe is finest.

Without risk, there can not be a benefit. There's very little to feel protected concerning when you invest in the market. But, as 2020 showed, it can transform in the blink of an eye. One minute you have a significant financial investment, and also the next, you have actually lost whatever. When you purchase genuine estate long-lasting, you know you have a valuing asset.

The 5-Second Trick For Maw Your Realtor

Numerous individuals buy property to supplement their retirement earnings. Whether you possess the property while you're retired, earning the regular monthly rental cash money circulation to supplement your income, or you sell a residential or commercial property you have actually possessed for years once you remain in retired life and make a profit, you'll boost your retired life revenue.If getting property and also leasing it out is also demanding for you, there are several other ways to purchase property, including: Buy an underestimated residential or commercial property, fix it up as well as flip it (fix as well as flip) Be a dealer functioning as the center guy between inspired vendors as well as a network of purchasers.

Spend in a Realty Investment Depend on If you wish to leave a tradition behind however don't think going money is a good idea, passing property down can be also much better. Not only will you have a peek at this site offer your heirs an income-producing asset, but it's also a valuing property. They can either maintain the residential property and let the heritage continue or sell it and also make revenues.

The Maw Your Realtor PDFs

For instance, let's claim you have $50,000 equity in a residence. You can refinance the home mortgage on it, obtain the $50,000, as well as use it as a deposit on your following building. Depending on the worth of your residential properties, you may even have the ability to pay money for future properties, boosting your portfolio and also the equity in it even much faster.While there's not a one-size-fits-all solution, there specify credit to search for when you purchase realty, consisting of: Look for a location that's appealing for occupants or with rapid valuing houses. Make Extra resources sure the location has all the facilities and comforts most homeowners desire Take a look at the location's criminal activity price, college rankings, as well as tax obligation history.

Report this wiki page